It’s official. AI is here and in the very near future, it promises to touch literally every aspect of our lives. More lifechanging than the launch of iPhones, more impactful than the creation of the Internet, more revolutionary than manufacturing automation in its day—it is changing the way work is done, how businesses operate, what producers create, and how we live our daily lives.

When a natural disaster, like a tsunami, occurs, those who prepare and proceed with caution are the ones who survive. Those who ignore the warning signs often face foolish consequences. As AI is coming, those who prepare and understand the enormity of this emerging technology will be ready and steadfast during the unknown. Those who embrace AI without asking the right questions and ensuring thoughtful adaptation of new technologies will be left with serious repercussions that will leave many with doubts about the safety of harnessing new technologies.

This reality can feel a little like being forced on a surfboard for the very first time in your life, in the waters of Nazaré, Portugal: completely overwhelmed, face-to-face with a world-record-breaking 100-foot wave. Given the immense magnitude of what’s welling up before us—the analogy isn’t that far off. None of us are immune. This is everyone’s first proverbial trip to the beach, and we’re defining the ride as we go.

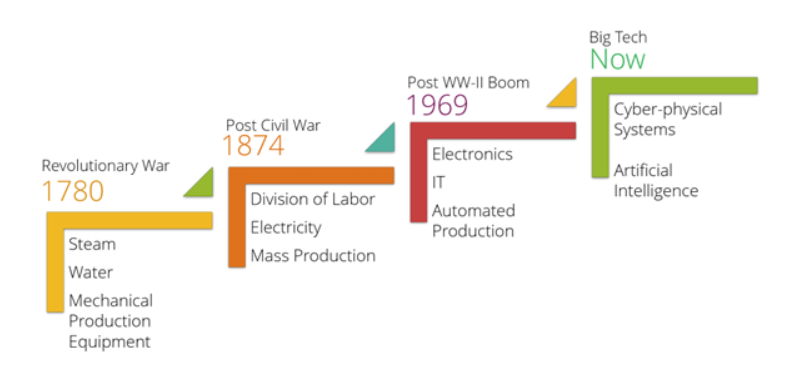

The Fourth Industrial Revolution

Of course, this isn’t the first time the world has experienced meaningful change. Historically, at once-a-century intervals—industrial revolutions have disrupted society by displacing workers with technology before emerging technology has gradually improved working conditions. In the Revolutionary War-era 1700’s, the use of steam and water replaced manual labor with mechanical production. In the post-Civil War 1800’s—mass production was born from the division of labor and the advent of electricity. Automated production leveraging IT and electronics displaced workers in the 1960s before previously unimagined careers came to be. As we approach a new era, we can either be responsible stewards of this change and learn from the past, or we can ignore history and be doomed to repeat the same mistakes.

Perhaps what makes today’s leap to cyber-physical systems and AI so alarming on the surface is the pace of the revolution we’re entering. When industrial revolutions replaced jobs in the past, no one knew that eventually new, improved jobs would come to replace physical labor. In an everything-everywhere-all-at-once fashion, most disciplines today are impacted in some way by AI, and the possibilities for transformation and innovation are endless, albeit unknown. This wave has the strong capacity to revolutionize work at a speed society will have a simply hard time keeping up with.

So, what do we do in the face of this giant wave? We get on our board and we learn to surf! For all its risks and overwhelming implications for the future—when leveraged responsibly—in equal measure, AI represents exciting opportunities for unprecedented innovation and revolutionary operational enhancements across virtually every industry.

What is Responsible AI?

With a rush of fear in the global public dialogue around AI and its potential negative impact on society—responsibility is a legitimate concern. We must learn from history and approach AI in a strategic and responsible manner.

But how does that relate to solutions in the tax assessment domain? Has there ever been a play for CAMA software being sold into a municipality as a “responsible” operational solution? Of course not, but with the birth of AI—the entire game just changed.

Accuracy

With the proliferation of machine learning and consumer-focused generative AI tools, publicly available property assessment data can now be easily leveraged by the common layperson for independent analysis. Performed on inaccurate data records—those public analyses represent a meaningful risk to tax assessors, and public faith in their offices.

Equity

In a similar vein, tax offices making data available to be transparent may reveal meaningful disparities in vertical equity easily discoverable by the public—creating the appearance of discriminatory valuation. Those counties will find themselves challenged to survive growing public scrutiny from expanding visibility to valuation anomalies such as these, and the potential for irreparably compromised trust in assessment methodology. That’s where companies like Farragut step in. By embracing the fourth industrial revolution, our team of innovators continue to ask questions, test technology, and run scenarios to ensure that information is fact checked, valid and secure.

Efficiency & Productivity

With a substantial contingent of experienced tax assessors retiring out of the profession in recent years, the amount of open roles begging for highly skilled practitioners are largely going unfilled. As a smaller number of less seasoned candidates fill an expanding number of roles, the need for generative AI solutions that fill the knowledge gap to ensure continued efficiency and productivity has intensified.

Transparency & Accountability

With the added public scrutiny that AI brings to the tax assessment practice—transparency has never been more important. From the efficacy of algorithms used to the defensibility of data accuracy—every output from an assessor’s office must be verifiable, explainable, and easily understood by the general public. By the same token, every technological solution deployed by an assessor’s office must be thoroughly tested to meet or exceed established IAAO standards of quality.

Facing the Wave Together

Our aim at Farragut is to be every tax assessor’s partner in navigating emerging technologies and using them responsibly. Our mission is to engage in this revolution with responsibility—designing novel products that embody transparency and accountability. With exciting things in store for assessors in the coming months, we’re energized by the challenge these developments represent.

That said, we recognize that even the most sophisticated tools being developed have no value if they don’t speak directly to the specific challenges of every unique stakeholder. Collaboration is vital to successfully navigating the world AI is transforming before us all, and illuminating our path to solution development serving the entire tax assessment community at this critical time.

So, tell us: What is your biggest operational pain point today? What barriers stand between your county assessor’s office and greater efficacy? What’s keeping you up at night? Join the conversation and let us know here!